There’s been a 14% increase in consumer food prices since July, 2022 which has its reasons of course but still makes US residents struggle to get by. It often happens that most of them don’t even have $1,000 in savings and have to apply for emergency financing to buy everyday goods of first necessity. Small payday loans seem to grow in popularity together with growing inflation and food pricing.

Table of Contents

What are the main reasons for Food Prices Rising?

After doing research on the economic situation in the US during the 2021-2022 years, we can name a few most important reasons that have led to 9.4% boost in prices for groceries. They are:

1. Inflation

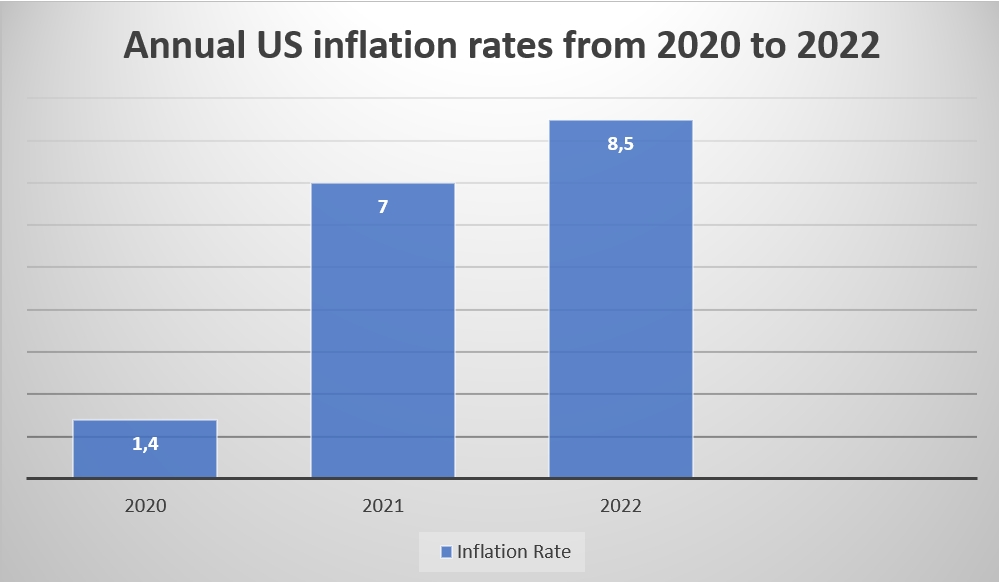

Americans experience the highest price increase for the last 40 years – according to the Consumer Price Index. As a result, there’s the strongest increase of food prices – 13.3% compared to 12.6% of May growth.

Сheck the annual US inflation rates from 2020 to 2022

2. Supply Chain Problems

People consume food quicker than farmers produce it. Especially it’s hard when the latter have faced troubles with the supply of seeds, fertilizers, equipment, etc.

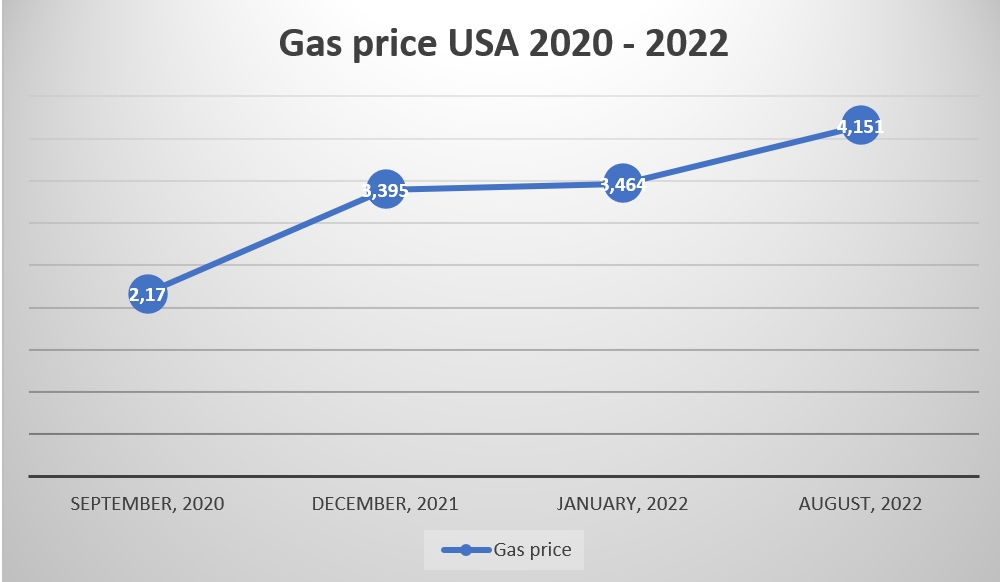

3. Transportation Costs

Lack of drivers, rising gas prices, various global problems caused by sanctions have led to the problems with shipping. The cost of transportation has increased by 34% since 2021. Goods which are imported from abroad experience even more difficulties – port congestion, etc.

4. Higher Energy Costs

Sanctions against Russia have resulted in extremely high energy prices which have gone up over 41% since June 2021.

5. Pandemic Disruptions

Work from home during the Pandemic, closing of restaurants and cafes, the tendency to eat more at home and but groceriws at a shop have all led to the increase of food cost.

Changes in Consumer Price Indexes for food from 2020 to 2022

Various types of food have suffered more or less from price rises. It all depends on whether they are produced locally or imported, whether the transportation is needed or not, and other factors. Let’s check the table below for the changes in the cost of the most frequently bought products:

| Consumer Price Index item | 2020 | 2021 | 2022 |

| Percent change | Percent change | Percent change | |

| All food | 3,4 | 3,9 | 8.5 to 9.5 (+) |

| Meats, poultry, and fish | 6,3 | 6,8 | 9.0 to 10.0 (+) |

| Meats | 7,4 | 7,7 | 7.5 to 8.5 |

| Beef and veal | 9,6 | 9,3 | 6.0 to 7.0 |

| Pork | 6,3 | 8,6 | 7.0 to 8.0 |

| Other meats | 4,4 | 2,9 | 12.0 to 13.0 (+) |

| Poultry | 5,6 | 5,1 | 14.5 to 15.5 (+) |

| Fish and seafood | 3,3 | 5,4 | 9.5 to 10.5 (+) |

| Eggs | 4,3 | 4,5 | 19.5 to 20.5 |

| Dairy products | 4,4 | 1,4 | 12.0 to 13.0 (+) |

| Fats and oils | 1,3 | 4,6 | 16.5 to 17.5 (+) |

| Fruits and vegetables | 1,4 | 3,3 | 6.5 to 7.5 |

| Fresh fruits and vegetables | 0,8 | 3,3 | 6.5 to 7.5 |

| Fresh fruits | -0,8 | 5,5 | 8.5 to 9.5 |

| Fresh vegetables | 2,6 | 1,1 | 4.0 to 5.0 |

| Processed fruits and vegetables | 3,5 | 2,9 | 8.5 to 9.5 (+) |

| Sugar and sweets | 3,3 | 3,0 | 7.5 to 8.5 (+) |

| Cereals and bakery products | 2,2 | 2,3 | 12.0 to 13.0 (+) |

| Nonalcoholic beverages | 3,6 | 2,8 | 7.5 to 8.5 (+) |

| Other foods | 3,1 | 2,2 | 12.0 to 13.0 (+) |

Of course, the prices may vary by store, your location, the quality of food, etc. But the tendency is as follows:

Since 2021 eggs have become 22.6% more expensive, meet – about 15%, fish – 12%, dairy products – 11%. It concerns not only foods bought at the grocery. Restaurant bills have also been affected. You are going to be charged 6 – 7% more at your favorite café than before.

What Experts Recommend to Fight Rising Grocery Costs

- Plan your meals

- Make a shopping list and stick to it

- Compare prices before shopping

- Look for discounts

- Take advantage of coupons and loyalty cards

- Buy in bulk

- Cook yourself

- Try being a vegetarian for a few days a week

- Look for cheaper ingredients

- Buy local seasonal foods

- Grow your own products

25% of Americans turn to loans trying to pay for necessities like food

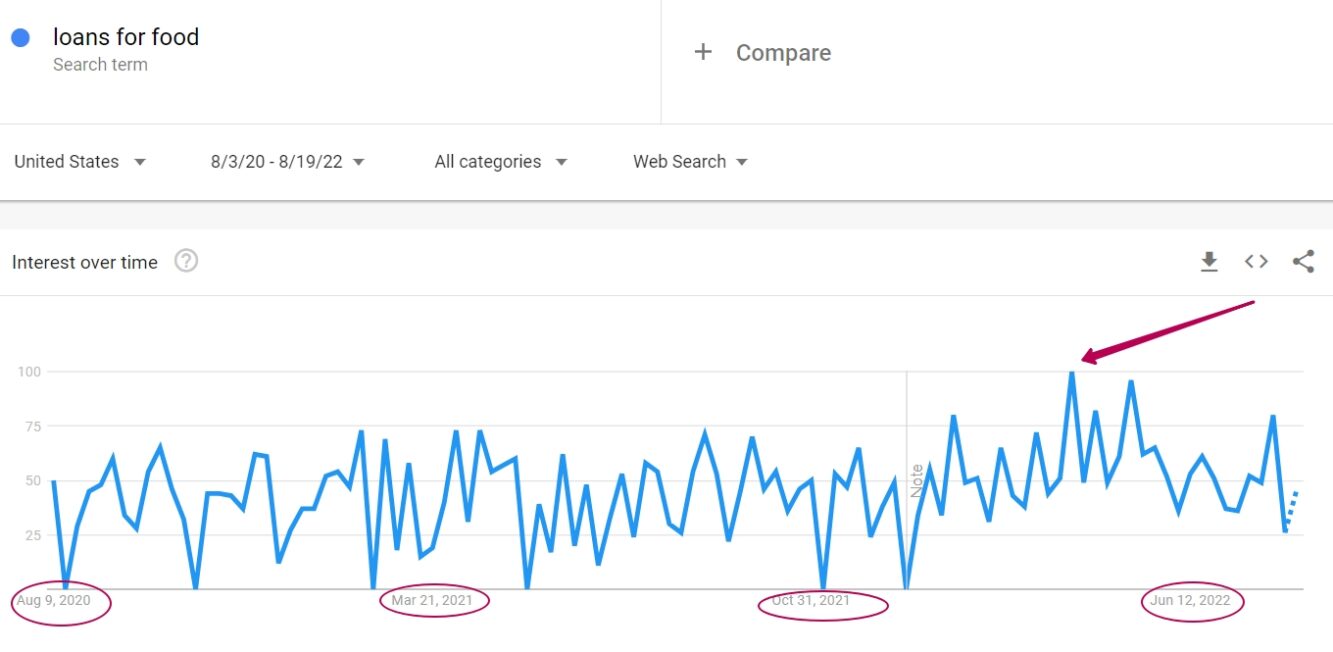

We already know that the prices are growing at an enormous rate. But are Americans borrowing more because of the food cost?

New York Fed has researched the borrowing tendency in the US and concluded that there’s been 13% rise since 2021. And the main reason for Americans to borrow more in 2022 is growing prices.

The average credit card debt of $6,506 is mostly contributed by basic things like food, utility bills, and rent.

If we check the Google Trends for “Loans for Food” search query, we’ll see that its popularity has grown significantly since 2020.

The most popular loan types borrowed by the US residents in need of emergency financing are short-term payday loans and unsecured personal loans. Besides, most people who lack money for groceries are likely to have a bad credit score. Naturally, they look for bad credit loans. And it’s probably the fastest and easiest way to get the funds. You apply online in minutes and get the loan on the same business day. Whether you buy food or pay urgent bills, it doesn’t matter. Lenders don’t ask for your reasons to borrow money. Just provide some proof of your ability to repay the loan on time and the problem is solved.