Title loan is a kind of loan that uses up your automobile to secure repayment. It is possible to use a Title Loan for different purposes like needing the money to refund unexpected expenses or cover medical bills. Your auto, boat, motorcycle, or any type of vehicle can be used as a collateral. Instant online title loans don’t affect your credit history. Most title lenders don’t require a hard credit check when you apply. This examination, called a hard inquiry, usually knocks five points off your credit score. If you don’t manage to pay off the loan in time, the lender can repossess your vehicle. A lien put on your auto by the lender becomes an obstacle when you decide to sell the vehicle.

Table of Contents

Is Bad Credit OK for Title Loans? Is it the reason for their boost?

A wide choice of loans is at your disposal if you have a good credit history. However, one with bad credit rating can apply for a Title Loan. The process of applying is quick and easy. For instance, Online title loans in Kansas only demand your ID, title showing sole ownership, proof of steady income.

The amount of money you can expect depends on the condition of your car and its value. All you need to pawn is the title to your car. You can still use your auto, but the title itself is left at the lender’s until the loan is paid off fully, including fees.

Facts about Title Loans in 2022

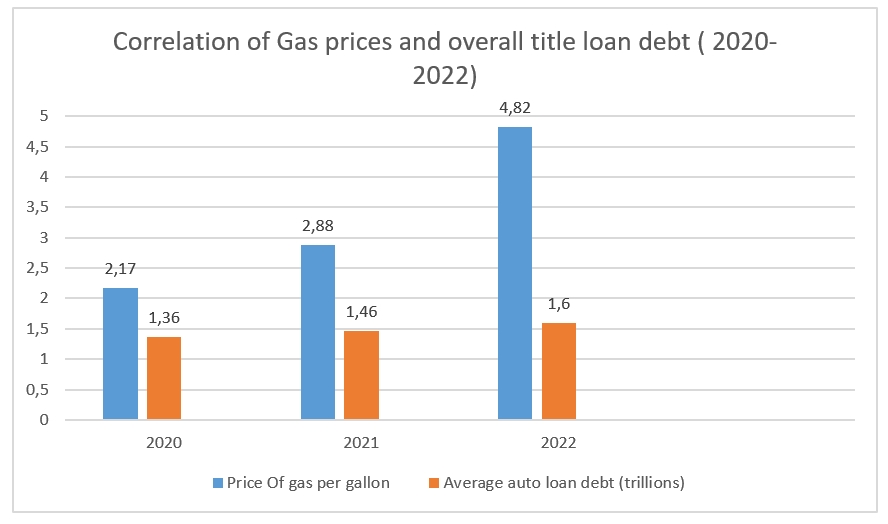

- It happens that starting from 2011 title loan debt has been growing steadily. Nowadays auto loan debt is equal to $1.46 trillion. It continues to rise steadily. Only 2020 showed a slight drop in the debt buildup due to the culmination of the pandemic.

- Rates and fees depend on warn-out-state of your vehicle. Lending rate shows the condition of the automobile.

- Standard fees on subprime auto lendings start from 9% to 20%. Only those applicants with positive credit history can approve for favorable rates. One with credit score lower than 760 gets less chances of approving for such low rates.

- Besides the growing interest rates, prices of new and used automobiles rose acutely between 2021 and 2022. Used cars have enlarged two-fold in price.

Inflation and gas prices growth in 2022

Recently new information about inflation showed that it gets more and more difficult for American citizens to buy cars. It happens because of the spiking prices of new and used cars. The growth amounts are of 12.6% and 16.1%, respectively.

It’s not only the pressure caused by inflation, growing interest rates has large impact too.

Several economical experts predict higher rates could hit consumers and the auto sector in a number of areas, including by making it more expensive to get Title Loans.

“I think when you look at every 100 basis point increase in auto loan rates, it’s about $15 to $20 [added] on a basis of about $600 on monthly payments,” said economical expert.

Rising fuel price influences loan popularity. The standard price of a gallon of gas is almost 5 $. This fact becomes a real problem for auto demand. And the point is that we expect prices to rise. This is an immense issue for people all over the country. We are paying unprecedented prices at the gas stations. Since fuel is an input price into nearly every product and service, we are paying more for everything. Therefore, American citizens appear in a difficult situation.

Title Loan Popularity

- Analyzing statistics of earlier years, standard pre-owned auto loan amount raised more than 20%.

- Citizens of United States get more than $60 billion in new auto loans monthly. Americans of 50 and less take out $37.9 billion in title loans each month. Citizens of 50 and older take out $21.0 billion.

- The last quarter of 2021 showed that Americans of 30 and 40 got the largest sums of loans, $41.4 billion and $42.3 billion, correlatively. Those of 50 and more took $10 billion less ($33.2 billion). Then go young people from 18 to 29, who got $29.9 billion.

- Title loan criminality rates stay declining at all degrees. 2010 year showed 5.3%, 4.0% of outstanding auto loans are at least 90 days past due. 5.0% are 30 days past due, down from 10.9% in 2009.

- During the past decade, medium auto loan amounts have grown steadily, hitting $39,721 for new cars and $27,291 for pre-owned cars.

- Usually, Americans with a credit score of 601 to 660 run the largest loans – $41,843. Debtors with credit scores of 661 to 780 get the most for used car loans, $29,065, which is significantly more than previous year ($22,708).

The number of Americans who applied to financial organizations for a Title Loan increased by 57% in July 2022 compared to the same period last year. Therefore, we can expect the growth of popularity of Title Loans as far as fuel prices continue to rise. The trend will last until the end of the year.