Payday Loan in Indiana

A payday loan might be extremely helpful in circumstances where you need quick access to cash on hand. If you need to borrow a modest sum of money, such as to mend a flat tire or pay an unexpected increase in prescription prices, this type of loan might be a smart choice. Only you can decide what’s best for you, but be sure to think about whether you’ll be able to afford to pay back a payday loan and its costs on time before you make a choice.

Quick Payday Loans Near Me are not meant to cover long-term expenses. A modest loan should only be utilized to cover immediate financial requirements. Your little loan in Indiana could cost more than loans provided by other lending institutions. The Indiana Department of Financial Institutions oversees small loans. Before paying the lender the cash equivalent of the small loan’s principal by the end of the business day following the day the borrower gets the loan funds, a borrower may cancel a small loan without incurring any fees.

What Are Repayment Options For Payday Loans In Indiana?

When your loan is due, loan provider will immediately deduct the entire balance due from your account using an authorized electronic withdrawal or, if you’ve given a permission, the debit card linked to your checking account, if you’ve provided one. If you require a different means of payment you can contact your lender. Please keep in mind that you should get in touch with the lender one banking day prior to the due date if you are unable to repay your loan in full on time. In Indiana, refinances are not permitted.

Select your city to find the best Payday Loan direct lenders near you

- Indianapolis

- Center

- Washington

- Wayne

- Fort Wayne

- Perry

- Portage

- Lawrence

- Clay

- North

- Franklin

- Bloomington

- Harrison

- Union

- Evansville

- Warren

- Noblesville

- Jackson

- Anderson

- Jeffersonville

- South Bend

- Calumet

- Columbus

- Pleasant

- Elkhart

- Carmel

- Fishers

- Lafayette

- New Albany

- Wabash

- Pike

- St. John

- Fall Creek

- Hammond

- Gary

- St. Joseph

- Muncie

- Penn

- Knight

- Hobart

- Jefferson

- Marion

- Terre Haute

- Adams

- Kokomo

- White River

- Concord

- Greenwood

- Madison

- Fairfield

- Ross

- Liberty

- Monroe

- Mishawaka

- Ohio

- West Lafayette

- Decatur

- Lincoln

- Vincennes

- Delaware

- Richland

- Van Buren

- Huntington

- Aboite

- Westfield

- Richmond

- Merrillville

- Wea

- German

- Valparaiso

- Goshen

- Brown

- Plainfield

- Guilford

- Michigan City

- Highland

- Pigeon

- Granger

- Crown Point

- Osolo

- Michigan

- Schererville

- East Chicago

- Sugar Creek

- Zionsville

- Brownsburg

- Cedar Creek

- Connersville

- Patoka

- Henry

- Hanover

- Greencastle

- Harris

- Greenfield

- Clinton

- Noble

- Munster

- Charlestown

- Peru

- Clarksville

What Are Requirements For Payday Loans in Indiana?

In order to qualify for a payday loan in Indiana, you must fulfill the following criteria. Those with bad credit are taken into account by the lenders, but you must meet certain standards.

- age of at least 18

- live in the US

- possess a functioning bank account so the lender can transfer the funds to you

- to receive texts, you must have an active mobile phone account

- earn more than $1000 each month

- being employed

Can I Still Get A Payday Loan In Indiana With Very Bad Credit?

Even those with poor credit might be able to get a loan in Indiana. Even if you’ve previously been denied a loan due to your poor credit by a bank, credit union, or app, you can still obtain a payday loan in Indiana. Most loan providers think you should always have the chance to recover your financial stability, even if you’ve made a mistake in the past that has hurt your credit score. Lenders, who work with borrowers from various walks of life, will assist you in beginning your search for the ideal payday loan right away.

Customers in Indiana may be eligible for a cash advance if they wish to borrow money without affecting their credit scores. It enables people to obtain the money they require without endangering their credit score. You can obtain financial aid even if you have terrible credit or no credit because direct lenders typically don’t conduct a rigorous credit check.

Are Payday Loans legal in Indiana?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Indiana. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Legal |

|---|---|

| Minimum Loan Amount | $50.00 |

| Maximum Loan Amount | $605.00 |

| Repayment Term | 14 - 30 days |

| Finance Charges | $15 for $100 borrowed for 14 days |

| Additional Fees | 15%: $0-$250; 13%: $251-$400; 10%: $401-$500 |

When Should I Apply for an Indiana Payday Loan?

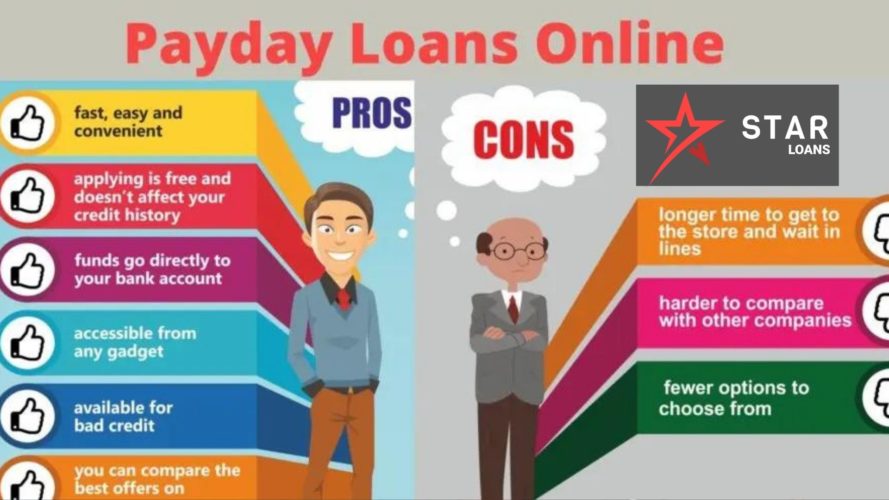

Paycheck loans are typically regarded as one of the greatest strategies to pay for unforeseen bills. Due to their high rates and restrictions, these loans are insufficient to cover long-term financial needs, although they might be useful in times of financial emergency. People who can’t rely on financial assistance from traditional lenders may find that short-term internet loans in Indiana are a viable option because they are also available to those with bad credit scores.

Customers in Indiana typically apply for fast cash loans for the following reasons: paying for daily expenses, covering medical crises, paying for repairs, paying off debt, and getting ready for the holidays.

Lenders are prepared to assist you in overcoming your issues if you encounter any of the aforementioned challenges or have an urgent financial need for any other cause. A lender will undoubtedly locate the ideal loan for your current requirements.

How Many Payday Loans are Permitted at Once in Indiana?

Residents of Indiana are only permitted a maximum of two payday loans from various direct lenders at once. Additionally, borrowers are only permitted to take out another loan a week following their previous six consecutive loans. The terms of your second loan, though, will be worse. If you want to apply for more than one loan, you should additionally confirm your ability to repay them both.

Payday Loan Calculator

$500 Your loan + $79 Your fee = $579 Total Cost*

* Total Cost - The sum of money you are to pay off within the term you’ve chosen if you borrow the stated above amount for the average (or required by your lender) APR.