Obtaining Cash Advances in Georgia

Georgians can still get loans from a variety of American online lenders. Ask about interest rates, lending maximums, and check customer reviews as the requirements for each lender vary. A copy of your driver’s license, information about your employment, and specifics about your bank accounts will all be required when you apply for a loan in Georgia.

The state of Georgia forbids non-banking institutions from issuing cash advances. Payday loans can still be provided to people by out-of-state banks as long as they are FDIC insured. Borrowers in Georgia who want to apply for a payday loan must:

- Be at least eighteen.

- Earn at least $1,000 per month at a stable job.

- Possess an active bank account with no overdrafts or negative balances.

- Provide Florida-based or having a US address.

- Be employed and receiving a monthly salary of at least $1000.

- Be able to pay monthly installments.

Why Could I Need a Payday Loan in Georgia?

When you require quick cash to cover an urgent or emergency expense, a payday loan in Georgia may be able to help. You can receive immediate approval and funding the day after applying with a simple online application.

The infusion of cash can help you pay off your unpaid bill and bring much-needed relief; also, you have the option to spread repayment over a lengthy period. You might need to look for the best payday loans in Georgia to get the one that’s perfect for you as payday loans are not permitted in every state but are in Georgia.

Select your city to find the best Payday Loan direct lenders near you

- Atlanta

- Augusta

- Columbus

- Macon

- Savannah

- Athens

- Sandy Springs

- Roswell

- Johns Creek

- Warner Robins

- Albany

- Alpharetta

- Marietta

- Smyrna

- Valdosta

- Brookhaven

- Dunwoody

- Peachtree Corners

- Mableton

- Gainesville

- Milton

- Newnan

- Rome

- Martinez

- East Point

- Tucker

- Peachtree City

- Dalton

- Kennesaw

- Redan

- Hinesville

- Douglasville

- Evans

- Statesboro

- Woodstock

- Lawrenceville

- LaGrange

- Duluth

- Stockbridge

- Chamblee

- Carrollton

- Canton

- McDonough

- Pooler

- Griffin

- Decatur

- Acworth

- Candler-McAfee

- Sugar Hill

- Union City

- Cartersville

- Snellville

- Forest Park

- Suwanee

- Milledgeville

- Thomasville

- St. Marys

- North Druid Hills

- Fayetteville

- North Decatur

- Tifton

- Norcross

- Kingsland

- Belvedere Park

- Calhoun

- Lithia Springs

- Brunswick

- Riverdale

- Perry

- Dublin

- Conyers

- Americus

- Winder

- Wilmington Island

- Villa Rica

- College Park

- Powder Springs

- Georgetown

- Druid Hills

- Moultrie

- Buford

- Fairburn

- Waycross

- Covington

- Monroe

- Grovetown

- Dallas

- Mountain Park

- St. Simons

- Clarkston

- Lilburn

- Richmond Hill

- Bainbridge

- Douglas

- Loganville

- Holly Springs

- Cusseta

- Cordele

- Vidalia

- Doraville

What Should I Think About Before Obtaining a Payday Loan in Georgia?

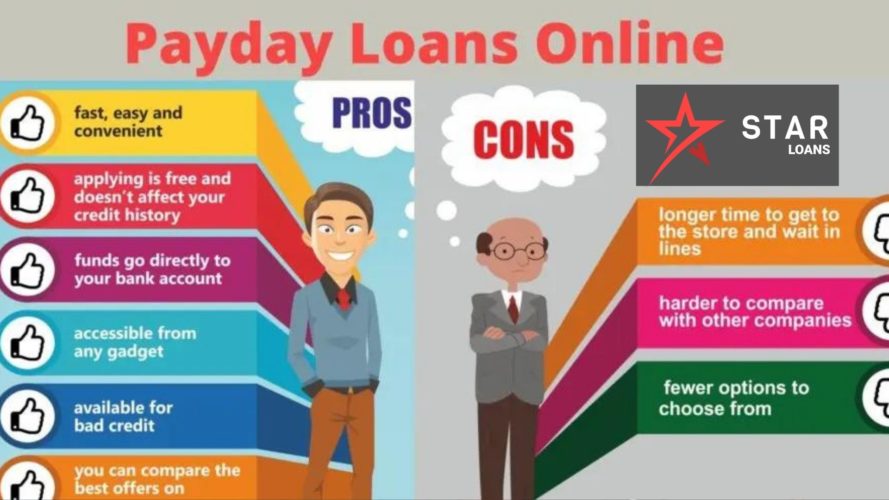

If a payday loan is the best choice for you, there are a few things to take into account. You may pay a little bit more in fees than you would for a typical personal loan or credit card, but the quickness and convenience are what you pay for primarily.

According to a prevalent belief, payday loans can become expensive if payments are not made on time, and they may also have a negative impact on your credit score. Therefore, it’s crucial to think about whether you have the financial means to pay back your debt on schedule, as well as how you plan to do so—whether from savings or your income from work.

In order to meet short-term financial demands until your next paycheck, you may be eligible for a payday loan in Georgia. Many customers are hesitant to deal with microfinance organizations. However in vain. The state has severe regulations governing their actions. There are no hazards if your duties are met on time. Additionally, banks punish willful defaulters with extremely harsh consequences.

Are Payday Loans legal in Georgia?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Georgia. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Available (with some restrictions) |

|---|

Do You Provide Payday Loans in Georgia for People with Bad Credit?

Loan providing organizations will match your loan inquiry with the lender who is most likely to approve you. The panel of lenders in Georgia is willing to take bad credit and low credit histories. The partners are aware that not everyone can have excellent credit, and there are a variety of circumstances in life that can make managing money challenging. You are definitely qualified for a payday loan if you reside in Georgia, have a continuous source of income, and are willing to accept and its partners’ benefit of the doubt.

You don’t need strong credit to be approved for a payday loan in Georgia, and you can get quick cash before your next paycheck. You can apply quickly and easily online or in-person, and you might get a response right away. If you apply in-person or complete your online application in Georgia, you can get the money that same day if you’re accepted. A payday loan from a Georgian trusted lender can provide you with the immediate cash you need, whether you need to pay for regular expenses or cover an unforeseen bill.

There are many different loan products on the market, so you should choose one that best suits your financial requirements.

Payday Loan Calculator

$500 Your loan + $79 Your fee = $579 Total Cost*

* Total Cost - The sum of money you are to pay off within the term you’ve chosen if you borrow the stated above amount for the average (or required by your lender) APR.