Payday Loans in Maine

No Denial Payday Loans from Direct Lender are accessible in Maine, assisting residents of different cities with bill payment. If you’re considering going into debt, find out how this adaptable alternative might be able to help you pay your payments for a while. The Maine laws and regulations governing payday loans are discussed in detail in this article.

What Does the Online Maine Payday Loan Application Process Entail?

The steps for applying for a payday loan in Maine are listed below:

Filling out the loan request form is the first step in applying for a payday loan in Maine. includes identifying information about the individual, such as name, address, phone number, and financial details. After reviewing the data, the lender considers whether to grant the loan. The third step entails the lender presenting a loan agreement to the borrower. The loan details, including the payback period, are described in the agreement. The contract is signed by the borrower. Finally, the borrower will pay back the loan plus interest when they receive their next salary.

Select your city to find the best Payday Loan direct lenders near you

- Portland

- Lewiston

- Brunswick

- Bangor

- South Portland

- Scarborough

- Gorham

- Auburn

- Biddeford

- Sanford

- Orono

- Saco

- Augusta

- Westbrook

- Windham

- Old Orchard Beach

- Kennebunk

- Waterville

- Winslow

- Topsham

- Skowhegan

- Kittery

- Falmouth

- Yarmouth

- York

- Farmington

- Hampden

- Houlton

- Standish

- Wells

- Rumford

- Freeport

- Berwick

- Fairfield

- Cape Elizabeth

- Gray

- Brewer

- Presque Isle

- Lisbon

- Millinocket

- Oakland

- Winthrop

- Bath

- Buxton

- Camden

- Bar Harbor

- Ellsworth

- Lincoln

- Cumberland

- Waterboro

- Caribou

- Bridgton

- Old Town

- South Berwick

- Bucksport

- Madison

- Norway

- Rockland

- Pittsfield

- Belfast

- Madawaska

- Dover-Foxcroft

- Eliot

- Fort Kent

- North Berwick

- Lebanon

- Wilton

- Hermon

- Waldoboro

- Turner

- New Gloucester

- Dexter

- Gardiner

- Poland

- Oxford

- Richmond

- Milford

- Paris

- Winterport

- Sabattus

- Fort Fairfield

- Fryeburg

Why You Need Payday Loans in Maine?

The demand for payday loans is at an all-time high right now. Quick loans remain a practical tool for financial management despite all the mixed reviews. Even worse than a sudden, one-time demand for extra cash is a chronic cash shortfall. However, the finest part about short-term loans is that they can assist you in simultaneously solving both issues.

There are several circumstances in which you can require additional funds. However, if you ever found yourself in one of these predicaments, loan providing organization is here to help. You didn’t receive a loan from your bank. Nobody is safe from experiencing a personal financial emergency. The fact is that it can take a month or even a year to persuade a lender that you need a bank loan or a home loan modification. It is significantly quicker to get a quick loan for a little time period to pay your rent or mortgage.

How to Become Eligible for a Payday Loan in Maine?

Applying for a quick loan in Maine is easy, but there are a few requirements that you should be aware of.

- You must be older than 18 years old. In the USA, lending money to a person who is under this age is prohibited. You now satisfy the first criteria if you are older than 18 years old.

- You must be a legitimate Maine resident. You must provide your contact address in order to be approved for a payday loan in the state of Maine. Following that, getting a loan is practically a given.

- Your poor credit is not an issue, but you still need a reliable source of income and a monthly income of at least $1,000. Lender can be certain that you can manage the repayment this manner.

- You need a working phone number and email address in order to get fast clearance. Loan provider won’t be able to get in touch with you if you don’t give this information.

- Finally, you must not be a bankruptcy debtor.

Are Payday Loans legal in Maine?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Maine. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Available (with some restrictions) |

|---|---|

| Maximum Loan Amount | $2000.00 |

| Finance Charges | $5 for amounts financed up to $75; $15 minimum charge for amounts financed of $75.01-$249.99; or $25 for amounts financed of $250 or more |

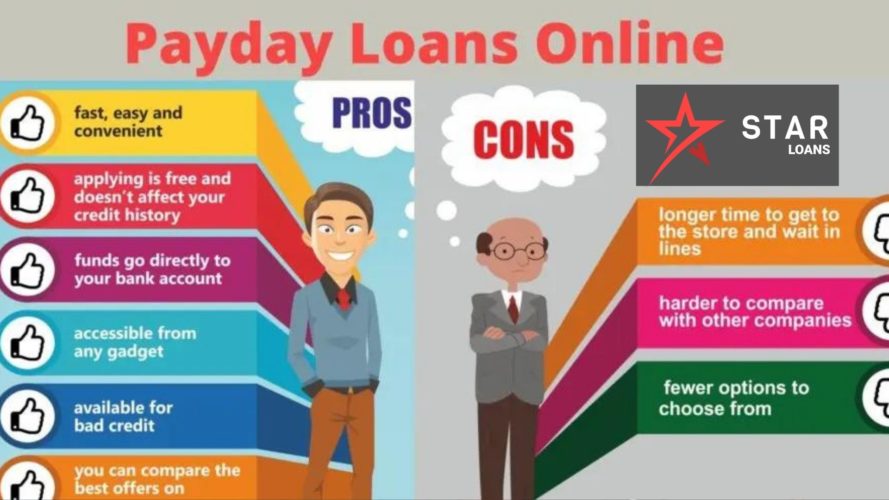

Online Loans—Are They The Best Choice?

Yes, those who lack the time to travel to a lender’s office might consider applying for payday loans in Maine online. Applying is simple, and you will receive a response quickly. Payday loans are obtained by borrowers who meet all standards. If the borrower’s loan application is accepted, they typically get their money that same day. A completed online loan application form can be submitted in in two to three minutes. Your greatest option is, and short-term loans don’t have an issue with terrible credit history. For customers who require quick access to additional funds, payday loans in Maine are a great choice. Borrowers are required to offer documentation of their employment, income, and contact information.

Can Someone with Bad Credit Get a Payday Loan?

If you match certain criteria and restrictions, you can obtain a payday loan even with bad credit. Your income is the primary factor that lenders take into account when deciding whether to lend to you. They also take into account how much you owe and whether you just paid off any debts. They should accept your assurances that you can pay back the money.

Payday Loan Calculator

$500 Your loan + $79 Your fee = $579 Total Cost*

* Total Cost - The sum of money you are to pay off within the term you’ve chosen if you borrow the stated above amount for the average (or required by your lender) APR.