Payday Loan Considerations

Same-Day Payday Loans are very popular in Wyoming. That is why this sector of the economy is home to hundreds of financial institutions. As a result, each borrower must exercise caution while selecting a lender. It is advised to give more consideration to the following crucial variables in order to prevent any unforeseen situations:

- The maximum amount the borrower may ask for from the lender (it is important to consider how much money the borrower needs to meet his demands);

- The duration of the borrower’s loan;

- The functionality of the lender’s website is one of the most important aspects because all of the processes are completed online. You should be mindful of the platform because of this. Identify its utility and whether you can do all loan-related tasks on the website;

- Read the reviews that have been published on specialized services.

- Additionally, it’s critical to check that the lender has a security system in place to safeguard the data provided by the borrowers and that there are no unstated fees.

Select your city to find the best Payday Loan direct lenders near you

Requirements for Payday Loans in Wyoming

The primary elements that are present in the majority of the forms are as follows:

- Contact details (email or phone number);

- The borrower’s state of residency (Wyoming);

- And the amount needed.

The lender needs contact information since the system automatically sends letters to the borrower’s email or phone number, which is used to verify that this is a real person who filled out the form. It assists businesses in avoiding circumstances in which nobody can timely repay payday loans.

Payday loan has a much better probability of being approved by the lender than of being rejected. To ensure that you receive the necessary amount, it is best to meet all of the lender’s requirements. Not all businesses are subject to the same rules. However, the following items are typically in the list of requirements:

- to reach the legal age of majority, which is 18 years of age or older for Wyoming residents;

- being Wyoming citizen with a permanent address (if a candidate listed their address on their application, they must provide documentation to support this);

- being a citizen of the United States or receiving permission to stay in the US for an extended period of time (at least for the duration of the borrower’s loan);

- to have a steady source of income for at least six months (the law allows for this time to be spent working for the same company or as a freelancer for six months);

- have an active bank account (only the borrower’s accounts may be used; it is not possible to obtain funds from another person’s account, even if it belongs to that person).

Are Payday Loans legal in Wyoming?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Wyoming. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Legal |

|---|---|

| Average APR | 260.00% |

| Finance Charges | $30 (or 20% per month) |

| Additional Fees | 20% maximum but not more than $20 |

Wyoming Payday Loans’ Benefits

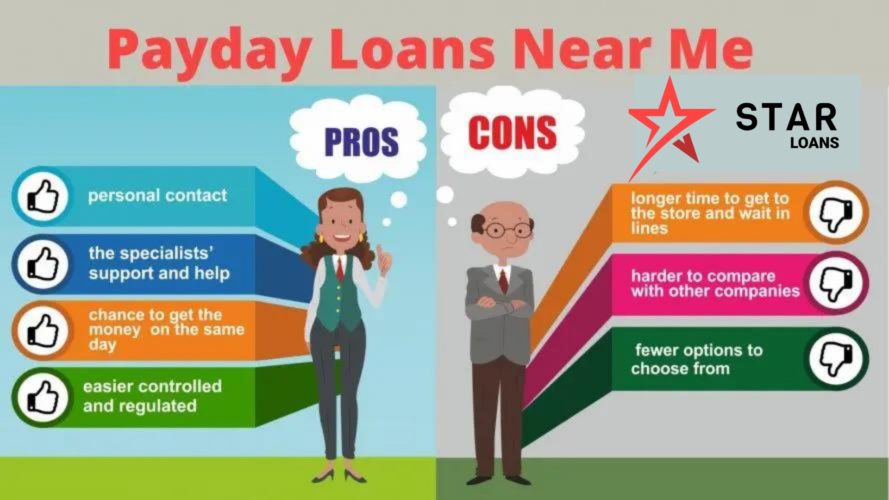

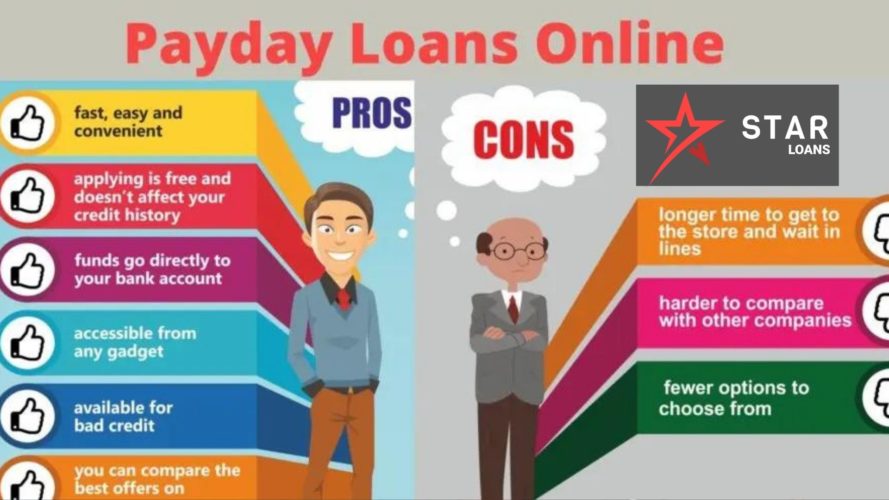

- Many choices. You have a lot of options between local businesses and internet lenders to obtain a payday loan in Wyoming.

- It’s acceptable to have bad credit. There is a strong possibility you will be authorized even if your credit history is less than ideal because Wyoming payday loan businesses check for a consistent work.

- Easy to apply. The application process is quite simple because all you have to do is upload your documents online, where they will be electronically checked. There is no requirement to fax documents.

- Quick cash. If your in-store application is approved, you will receive the funds immediately. The money is deposited either the same day or the following with online retailers.

Payday Loan Calculator

$500 Your loan + $79 Your fee = $579 Total Cost*

* Total Cost - The sum of money you are to pay off within the term you’ve chosen if you borrow the stated above amount for the average (or required by your lender) APR.