What are El Paso, TX Payday Loans?

A payday loan is designed to help borrowers cover short-term emergency needs by offering fast cash secured by their next paycheck. It’s usully used as the small-dollar cash advance to cover unexpected expenses.

The El Paso, Texas Payday Loan is usually due after 14 – 30 days since being deposited into the borrower’s account. After you get the next pay check, the cost of the loan including interest and fees is withdrawn from your checking account automatically.

Payday loans in El Paso, TX are often used by consumers to consolidate debt, to pay off bills, repair a car or redecorate a house, etc. Start with online application or look for loan store locations near you.

How do Payday Loans online work in El Paso, TX?

El Paso, TX payday loans are a quick, safe and convenient way to cover emergency expenses. Like all other short-term cash advances in Texas Payday Loans are regulated by the state’s laws. It’s highly recommended to study them in detail before submitting a loan request.

As soon as you’ve decided to apply for the necessary amount there are simple steps to go:

- Fill out an application form online or in any store in El Paso, TX;

- Get matched with a suitable direct lender;

- Receive the money same day in a loan shop or within 1 – 2 days after being approved online.

What are the benefits of El Paso, TX Payday Loans online?

Payday Loans are a perfect option for El Paso residents in the following situations:

- You’ve been rejected by banks and credit unions for your bad credit or bankruptcy or any other reason.

- You like 70% of Americans lack money to pay for everyday bills, utilities, rent, or

- You have numerous debts which must be repaid urgently or they may lead to enormous rates. Use a loan to consolidate these credits into one.

- You feel ashamed or embarrassed to ask your relatives and friends for help.

- You have a not very good credit history and don’t want to affect it by numerous loan requests. No credit check Payday Loans are perfect for you.

Choosing an online Payday Loan to overcome any of the mentioned above situations you get:

- Instant financing

- 24/7 online service

- Cash advance for bad credit

- No hard credit check loans

- Convenient online application

- Reputable direct lenders with no intermediaries

- What are El Paso, TX Payday loans eligibility criteria?

To be approved for a short-term cash advance a borrower needs to:

- Be over 18 years old;

- Be a resident of Texas;

- Have an active banking account;

- Provide a proof of income.

The eligibility criteria may vary according to the lender but all in all they are pretty much the same and don’t usually include any minimal credit score or income requirements.

How much do Payday Loans cost in El Paso, Texas?

The cost of Payday Loan as well as any other cash advance in El Paso consists of the principal, the annual percentage rate, or APR and some additional financial charges. The APR varies from 300% to 1200% but on average it’s 400%. It depends on the loan amount, your credit score, the state’s limit, the lender, etc. Besides, you may be charged additional fees such as:

- Verification or loan processing fee.

- Acquisition charges.

- NSF fee, etc.

El Paso Payday Loans are called short-term as they must be repaid till your next paycheck, usually within a month. Lenders usually allow to prepay earlier without any additional fees. In case you can’t pay the money back on time, you may apply for a rollover, extension or repayment plan.

Find out these details with the lender before you submit the loan request.

Can Texas borrowers get a Payday Loan with bad credit?

If you are looking for a Payday Loan online in El Paso, Texas and you have a bad credit score, you’d better start with online application. You’ll have more chance to find a lender providing such cash advance.

Most of them will approve you for the necessary funds no matter what your credit rating is. They may charge higher interest to make up for the risk. But on the whole bad credit cash advance doesn’t differ from traditional loans.

You apply online and the funds will be in your account within 1 – 2 days, or even same day regardless of the figures on your credit report.

NO credit check Payday Loans in El Paso, TX?

If you used to have some previous debts, or bankruptcies which affected your credit history and your score is not so good as you wish, you may apply for a Payday Loan with no credit check. In El Paso there are lenders providing quick funds with no hard inquiry to the major credit bureaus. They determine your creditworthiness paying attention to your income rather than credit history. But you should be careful and make sure you can afford the loan before applying for it.

Warning about El Paso, TX Payday Loans

We can’t but agree that Payday Loans in El Paso, Texas are one of the easiest and fastest ways to receive urgent financing. But you may come across some pitfalls on the way too quick money:

- Additional fees;

- Scams;

- Default penalties;

- Collecting practices;

- Third parties selling your information, etc.

Make sure you borrow from a legal El Paso lender and read the agreement carefully to be on the safe side.

El Paso, TX alternatives to Payday Loans online

If for some reason you want to avoid a short-term Payday Loan, you can choose among the other cash advances available in El Paso:

- Installment Loans up to $5000 for several months;

- $5000 – $35000 Personal Loans repaid in 6 months – 7 years;

- Secured Car Title Loans;

- Various Government Assistance programs;

- Bank loans, etc.

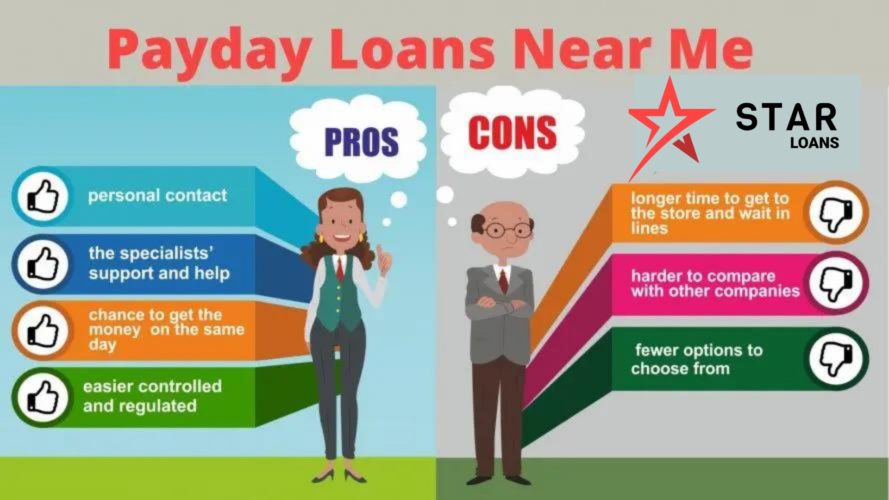

Start your Payday Loan application online or find cash advance locations in El Paso, TX on the map

-

Action Express Loans

-

4665 Montana Ave

(915) 565-3274

-

4665 Montana Ave

-

Advance America

-

12210 Montwood Dr Ste 112

(915) 857-7895

-

1320 N Zaragoza Rd Ste 121

(915) 858-5712

-

8900 Viscount Blvd Ste Ao

(915) 591-7726

-

2000 N Lee Trevino Dr Ste B

(915) 595-5913

-

9008 Dyer St Ste F

(915) 757-1866

-

12210 Montwood Dr Ste 112

-

Cash America Pawn

-

1478 George Dieter Dr Ste L

(915) 849-0018

-

6351 S Desert Blvd

(915) 225-3882

-

424 N Yarbrough Dr Ste S

(915) 593-3732

-

1478 George Dieter Dr Ste L

-

Cash Store

-

10705 Gateway Blvd W 103

(915) 591-9890

-

1830 N Zaragoza Rd Ste 104

(915) 856-9900

-

3010 Saul Kleinfeld Dr Ste D

(915) 855-7733

-

9411 Alameda Ave Ste I

(915) 872-8560

-

7447 N Mesa St

(915) 584-1501

-

5620 Dyer St

(915) 564-1801

-

8820 N Loop Dr Ste 100

(915) 860-9119

-

10705 Gateway Blvd W 103

-

LendNation

-

6529 N Mesa St

(915) 307-4063

-

6529 N Mesa St

-

Moneytree

-

6044 Gateway Blvd E Ste 211

(915) 772-6800

-

6044 Gateway Blvd E Ste 211

-

PLS Financial

-

9155 Dyer St

(915) 313-4208

-

9155 Dyer St

-

Power Finance Texas

-

1900 George Dieter Dr

(915) 856-4444

-

1900 George Dieter Dr

-

Quick Loans

-

1810 George Dieter Dr

(915) 704-4052

-

1810 George Dieter Dr

-

Texas Car Title & Payday Loans

-

1718 N Zaragoza Rd

(915) 855-0440

-

5354 Doniphan Dr

(915) 842-8022

-

9100 Dyer St

(915) 751-7277

-

428 N Yarbrough Dr

(915) 633-1542

-

5201 Fairbanks Dr

(915) 757-1144

-

6227 Airport Rd

(915) 772-2117

-

4135 N Mesa St

(915) 532-5323

-

1718 N Zaragoza Rd

-

Texas Car Title & Payday Loans Inc.

-

7230 Gateway Blvd E Ste E

(915) 592-3110

-

6600 Montana Ave Ste G

(915) 781-1172

-

5710 Alameda Ave

(915) 781-7490

-

7230 Gateway Blvd E Ste E

-

Texas Car TitlePayday Loan

-

421 N Zaragoza Rd

(915) 859-7640

-

421 N Zaragoza Rd

Check Payday Loan rates and terms in the other cities of Texas

- Houston

- San Antonio

- Dallas

- Austin

- Fort Worth

- Arlington

- Corpus Christi

- Plano

- Laredo

- Lubbock

- Irving

- Garland

- Amarillo

- Grand Prairie

- Brownsville

- McKinney

- Frisco

- Pasadena

- Mesquite

- Killeen

- McAllen

- Midland

- Waco

- Denton

- Carrollton

- Abilene

- Round Rock

- Beaumont

- Odessa

- Pearland

- Richardson

- College Station

- Tyler

- Wichita Falls

- Lewisville

- The Woodlands

- League City

- San Angelo

- Allen

- Sugar Land

- Edinburg

- Mission

- Bryan

- Conroe

- Longview

- Pharr

- Baytown

- Missouri City

- New Braunfels

- Temple

Payday Loan Calculator

$500 Your loan + $79 Your fee = $579 Total Cost*

* Total Cost - The sum of money you are to pay off within the term you’ve chosen if you borrow the stated above amount for the average (or required by your lender) APR.