A quick and convenient Payday cash advance is available online 24/7 for any borrower no matter what their credit score is. Just fill out a free application form and get the money same day after approval.

12 million adult Americans take Payday Loans annually. On average, it’s eight loans of $375 each per year plus $520 interest. 5.5 % of adults nationwide have used a payday loan in the past five years, more and more choosing online products. Let’s see why online Payday Loans have become so popular, what are their benefits and how to get the necessary funds faster and easier.

Table of Contents

Online Payday loans

Let’s mention once again what are the characteristics of Payday loans, how and where you can get them:

- It’s a short-term small-dollar cash advance in the amount up to $1000 paid back with your next paycheck in 14-30 days.

- They are famous for being quick, easy, convenient, unsecured, available for bad credit, but charged rather high APR for.

- Any resident of the state has the right to apply for it if he is over 18, has a permanent job with a stable income and a valid bank account.

- One can get a Payday Loan online and in a store.

Online Payday Loans for bad credit

Poor credit is not a problem for getting approved for a Payday cash advance. If you request a loan online, you’re likely to receive the funding no matter what your credit rating is. Payday Loans for bad credit are available for any residents of the USA older than 18 with a valid banking account. If you need up to $1000 and don’t have other outstanding debts, and can prove your income, apply for the necessary payday advance online.

Payday Loans online same day

If you choose to apply for a Payday Loan online, and you need to get an instant cash advance, make sure direct lender offers loans with the same day deposit. To assure quick funding fill out a simple application form online and submit it before 11 am on weekdays. If you apply at the weekend, you are likely to wait till Monday or even Tuesday. The same conditions refer to banking holidays.

Fast Payday Loans Online

The fastest way to get a Payday Loan is by applying online. It takes only a few minutes to fill out a loan request, gets verified, and approved for the loan. There’s no need to drive to the store, to wait in lines, to fax any papers, etc. To get instant cash advance you only need a computer or mobile phone and the Internet. It’s really fast and convenient.

Easy Online Payday Loans

What can be easier than applying for a Pay day loan online? There’s a variety of lenders to choose from. Most of them provide detailed information on the way Payday Loans work. You can also find verified customer reviews. It’s also useful to compare the rates and terms to choose the best Payday Loans online.

Apply nowPayday Loans online from direct lenders

If you already have some experience borrowing money or are good at surfing the Net and doing research online Payday Loans form direct lenders will definitely suit you. At the modern age of high technology and the world wide web, the majority even order food, buy clothes, book tickets, etc. online, to say nothing about borrowing money. No doubt, it’s faster, easier, and more convenient.

- You fill out a free application online. It doesn’t affect your credit history as usually doesn’t imply a hard credit

- In some minutes you are connected to the direct lender, who verifies your information.

- In case you are approved you get the money into your account in less than 24 hours.

Or you can use the service of a lending broker company that will provide you access to many lending organizations so that you can choose. Or, which seems the wisest way, compare both online and in-store lenders near you, or in your city, or in your state and decide whose rates and other conditions suit you best.

Payday Loans Online no credit check instant approval

If you are in a really urgent need of money and look for quick cash with no credit check, no Teletrack, no faxing, no driving apply for a Payday Loan Online. Most online direct lenders promise instant approval without doing a hard inquiry. They determine the borrower’s creditworthiness by the proof of your income and employment as well as other factors.

NO credit check payday loans are fast and easy as you avoid much paperwork and faxing. And you can get same day funding even with a bad credit score.

Best Online Payday Loans

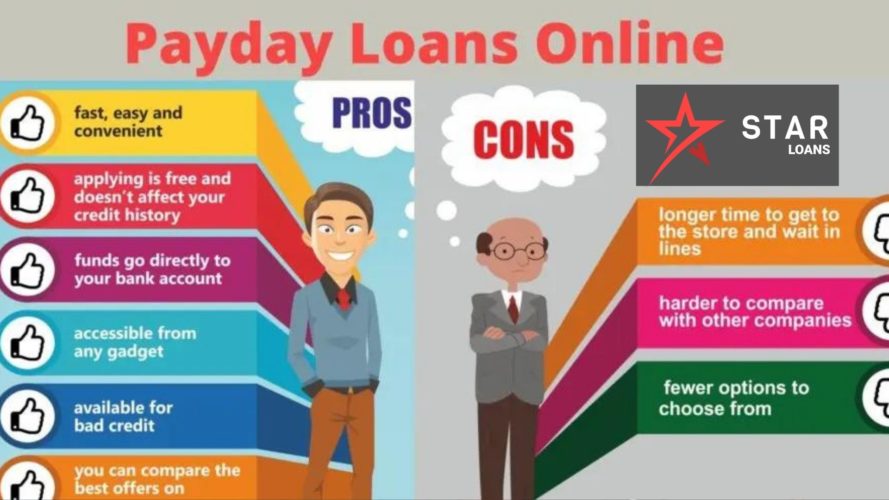

To choose the most trusted Payday Loans online with the lowest rates and fees and most convenient repayment terms you should take into account all pros and cons of an online cash advance.

Pros

- fast: 1 minute to apply, instant approval, less than 24 days to get money;

- easy and convenient: no driving, no paperwork, no waiting in lines;

- applying is free and doesn’t affect your credit history;

- funds go directly to your bank account, you don’t have to get cash, deposit it into your account or leave a postdated check;

- accessibility: every person possesses a smartphone or laptop and can easily go online

- available for candidates with low (about 600) FICO credit score;

- being able to compare a lot of lenders with their rates and fees at one time.

Cons

- There can be some scams, who want just to get your private information. So be careful, before applying check whether the lender is authorized and legal. You can do it with a quick Google search; go to trustpilot.com, call the Better Business Bureau at www.bbb.org or speak with a customer representative for that company.

- It sometimes can be rather expensive, you may be charged additional fees such as verification, database, administration fee. But it’s easy to avoid overpayment if you study and compare all the offers at first.

- Even if you pay off the loan earlier than agreed there won’t be any prepayment penalties, but there won’t be any savings either.

Safe Online Payday Loans

Any Payday Lender: online or in-store – must meet certain requirements. Both storefront and online payday lenders must follow the lending law, rules, and regulations in their state. While it is easier to spot an unreliable store-front lender, it’s not as easy to spot an unscrupulous online lender. But you can always do some research and check it yourself. Just be attentive and remember about your rights:

- You must be provided with all the details of the interest rates. Any hidden fees are prohibited.

- In most cases a written agreement must be signed.

- You must be given all the information including address, telephone, other contacts of the lender.

- You can check whether the lender is licensed and OLA certified, you’d better avoid others as dealing with them doesn’t guarantee your protection.

If you apply online you can get all the information about the company on their official website and ask any question or complaint to the CPFB.

Not to get scammed follow these easy rules:

- before applying to find out as much information as possible

- don’t hesitate to ask questions, to read the reference or ask for any documents proving the legitimacy of the lender

- don’t e-mail or transfer by any other means your private information, before doing it check that the website is secure

Our service is absolutely legal, free, reliable, and safe. We protect your rights and personal information. Working with us you save time and money getting the chance to compare more than 300 direct lenders at a time and choose the best rates. If you are looking for a cash store near you, no problem, compare the best offers on our website as well.