Table of Contents

What is flex lending?

Flex lending is one of the non-bank products offered to individual customers. It consists in making a certain amount of money available, which can be used after the own funds are exhausted. It is not a standard loan that is repaid in installments, but rather a form of “rainy day” cash. It is often explained as a “financial cushion” or “parachute” for unplanned, sudden expenses. Instead of painful falls and financial shocks, the expense can be spread over time, thanks to which we will maintain current economic liquidity. The flex loan is a revolving product, which means that the amount specified in the agreement will be available until the termination of the loan agreement.

Is flex a loan?

It’s hard to say that a flex loan can in principle be considered a loan in its purest form such as no credit check payday loans online, since, unlike regular loans that you receive on a card in full, flex loans give you access to a certain amount of funds that you can use for a specified period, which must be included in the contract.

How does a flex loan work?

Let’s assume that we have $2,000 as our own funds and $5,000 made available as a flex loan. We want to buy furniture for $4,000 – that is, for an amount higher than we have in private cash. The transaction will be settled in such a way that the money held in person is debited first, and then the remainder of the flex loan will be debited. This means that $2,000 will be transferred from our account and the flex loan will be reduced by $2,000. From the date of breach of the flex loan, interest is charged in accordance with the contract signed by us. The liability is repaid when the account is credited with any funds.

Is a flex loan secured or unsecured?

The advantage and main difference between a flex loan and a line of credit at a bank is the fact that non-bank companies provide you with the opportunity to get an unsecured loan with a bad credit history and without guarantors. It is these factors that make flex loans so popular among people of various income levels and opportunities. We must not forget that applying for a flex loan takes only 15 minutes and does not require unnecessary formalities.

How much can you get with a flex loan?

On average, you can get from 100 to 5,000 dollars. To apply for a flex loan, you need to be over 18 years old, has full legal capacity and show a valid identity card. Note – driving license, or student ID are not accepted as identity documents.

When talking about the costs related to the flex, there is a significant difference between this product and standard loans. Namely: an unused, intact flex loan does not generate additional fees or interest. This is very good information for people who do not feel the need to get into debt, but prefer to have funds “for a rainy day”. Other solutions, such as same day payday loan online or credit card, will generate fees, even if we do not use them. The loan will generate interest and the credit card will be charged for the lack of annual turnover. If we use a flex loan, any receivables are charged for:

- Commission for granting a flex loan – a one-off fee paid when disbursing a revolving loan;

- Interest for funds used – standard procedure of earning on money borrowed by the lender;

- Loan renewal fees – a recurring, annual fee charged for extending the contract for another year, usually cheaper than the commission.

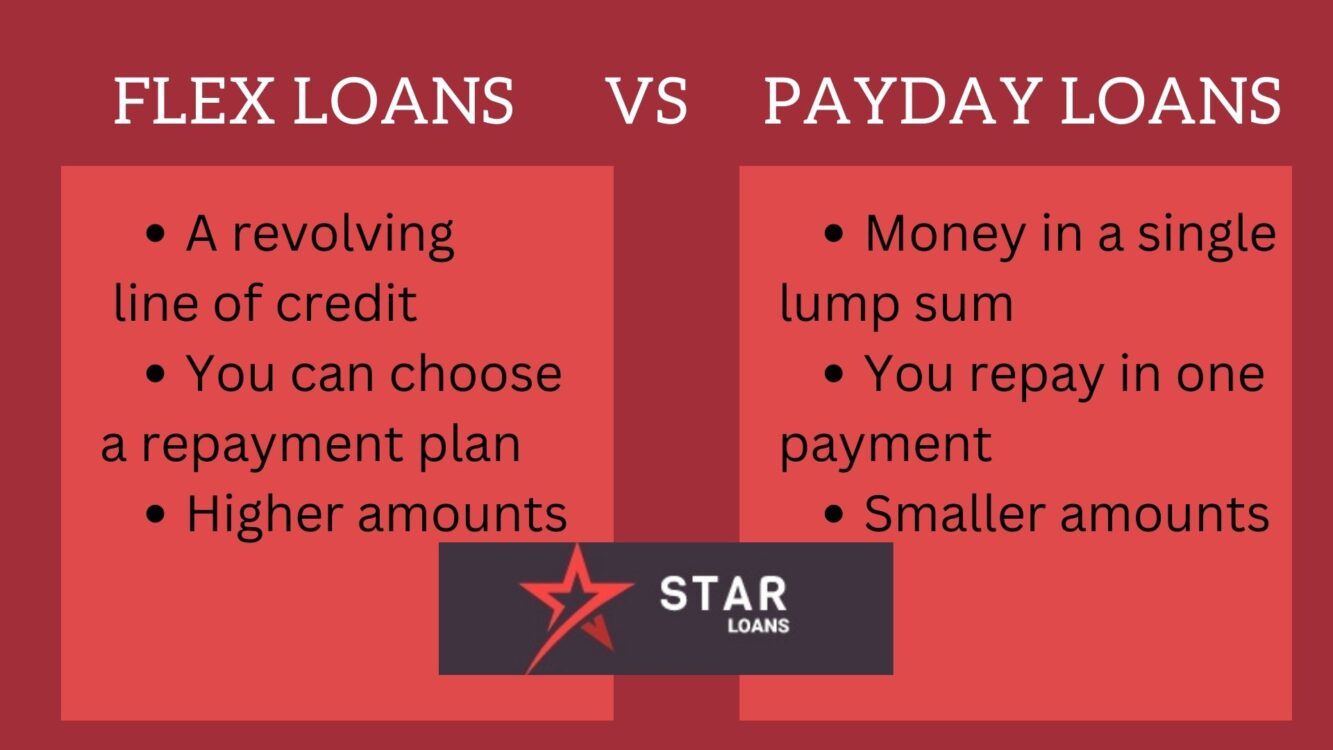

Is a flex loan a payday loan?

Definitely not. Payday loans are characterized by a short repayment period and a high APR of 390%. This is significantly higher than in the case of flex loans. In general, flex loans are more similar in structure to lines of credit than classic payday loans.

Besides, Flex Loans can be a part of government loan programs which you might be eligible for.

Pros and Cons of Flex Lending

Before choosing Flex Loans as the financing source, consider the benefits and drawbacks of this loan type:

| Pros | Cons |

| – Flexible repayment

– Easy online application – Instant approval – No credit checks – Available for bad credit – Same day transfer to your checking account |

– High interest rates

– Risk to overspend and get into debt – Longer repayment |

When will a flex loan be useful?

The flex loan is one of the most popular non-bank products next to payday loans, installment loans and car title loans. A flex loan is a great tool for people who keep their home budget at a stable level but are afraid of unexpected expenses. Costly car repairs, repairs after flooding or paying for treatment are examples of such events that we will finance with funds from the flex loan.